Order Sync for Google Shopping

Pre-Installation Order Sync for Google Shopping

Post Installation process Order Sync for Google Shopping

How Tax Component of a Sale will be Synced by our app to Shopify?

Jun 12, 2025

A Marketplace Facilitator is defined as a marketplace that contracts with third-party sellers to promote their sale of physical property, digital goods, and services through the marketplace.

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from a third party seller to the marketplace facilitator. For example, if you sell on Google's marketplace, Google will be responsible for calculating, collecting, and remitting tax on sales of your product’s shipping to states where Marketplace Facilitators and/or Marketplace collection legislation is enacted.

Moreover, as we know that Market facilitator tax law passed in the United States by individual states. To know more about Marketplace Facilitator tax, and for the list of states where this tax is applicable kindly refer given link https://support.google.com/merchants/answer/9169947?hl=en

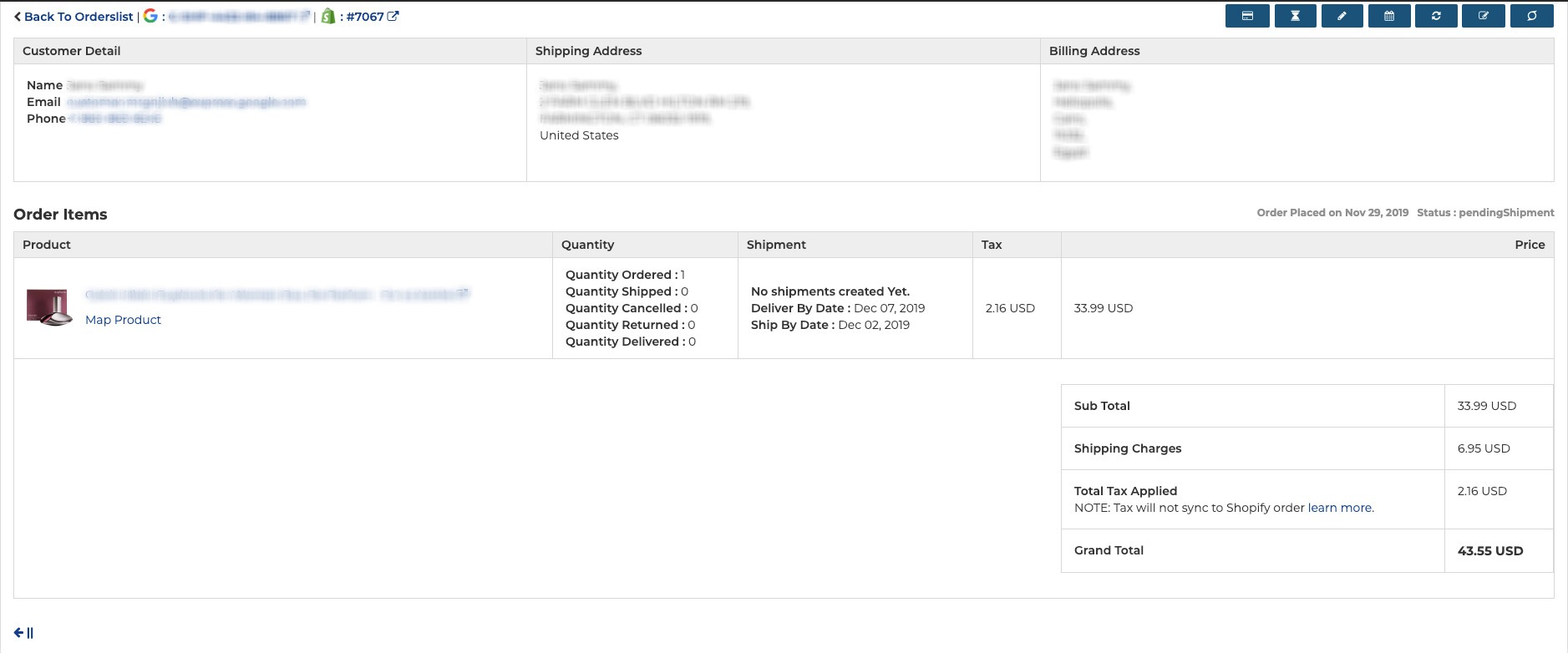

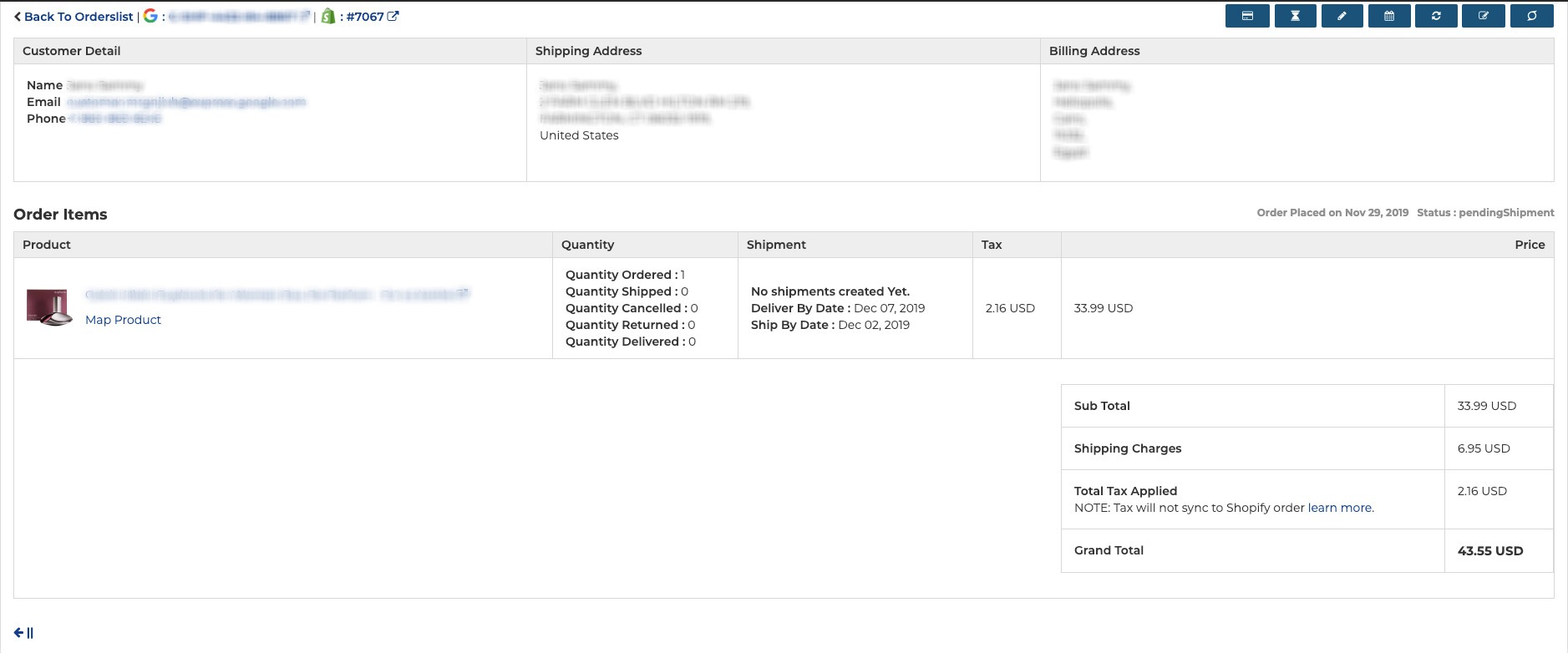

Our app Order Sync for Google Shopping comes under this law and it will not sync tax for Shopify order for those states they come under this law and opted. To have a clear understanding, let's take an example. We will be dealing with 4 different scenarios.

1. Scenario 1: Seller and Customer both are from California where Marketplace facilitator tax is applicable and the Marketplace is Google. Now, a customer is purchasing a mobile case worth 10USD. So, a customer will pay the original cost + tax to Google. Google will collect the tax from the customer and it will pay tax to the respective state authority. Since Google is going to remit the tax collected to respective state authority, our application doesn’t sync tax component for this order to Shopify where marketplace facilitator tax is applicable.

2. Scenario 2: Seller and Customer both are from the Delaware where Marketplace facilitator tax is not applicable and the Marketplace is Google. Now, a customer is purchasing a mobile case worth 10USD. So, a customer will pay the original cost to Google along with the state sales tax which is applicable because the location of the customer and marketplace is not part of this law. In this case, our application will sync the tax component for the given Shopify orders and it will reflect in the Shopify Order details.

3. Scenario 3: Seller is from California where Marketplace Facilitator law is applicable but a customer belongs to some other state where marketplace facilitator tax is not applicable. Here, the marketplace is Google. Now a customer is purchasing a mobile case worth 10USD. In this case, marketplace facilitator tax will not be added and a customer will not pay any other taxes like sales tax. Hence, the customer will only pay the original cost of the product. Here, our application will only sync order information, without tax.

4. Scenario 4: Seller is from Delaware where marketplace facilitator tax is not applicable, but the customer is from California where Marketplace facilitator tax is applicable. Here the marketplace is Google. Now, a customer is purchasing a mobile case worth 10USD. In this case, the marketplace facilitator tax will be added because a customer is located in the region where marketplace facilitator tax is applicable. Since Google is going to remit the tax collected to respective state authority, our application doesn’t sync the tax component for the given Shopify orders.

Order Sync for Google Shopping

Pre-Installation Order Sync for Google Shopping

Post Installation process Order Sync for Google Shopping